AutomatedTradingon Forex market

Manual trading poses a number of challenges for traders. One of the main problems is emotional decision making, which can lead to impulsive actions and inconsistent results. We have solved this problem - Robot ORCA

The main problems

of manual trading

Emotions

It is difficult to avoid impulsive decisions dictated by fear or greed during trading

Concentration

The need to constantly monitor the market and news takes a lot of time and effort.

Discipline

Lack of discipline in adhering to trading strategies and risk management rules hinder traders' success.

Decision

Forex trading requires precise analysis and high concentration, which is difficult to maintain around the clock. This is why automation becomes the ideal solution. Our robot is powered by advanced algorithms, taking into account market trends and data to make decisions based on facts, not emotions. It analyzes hundreds of factors in real time, adjusting to changing market conditions. This means your trading becomes more stable and efficient, freeing you from constant monitoring and minimizing the risk of mistakes.

Key advantages

Round-the-clock

trading

The robot works continuously 24/7, you will not miss a single profitable opportunity.

Transparent

history

We have a history of his training, as well as reports of actual work over several years that can't be faked.

Adaptation

to market conditions

Robot algorithms automatically adjust to market fluctuations and trends, increasing the accuracy and stability of its decisions in any situation.

Creating the robot

The Orca robot was invented, developed by IT Creator Middle East (U.A.E). Specialists from UAE, Israel, USA were involved in its creation. The robot was tested for more than 2 years, was tested with different situations on the currency markets. All tests were conducted on 6 currency pairs (15-year chart) max drawdown reached 65%. After successful tests, the team decided to make the robot even more reliable and removed the sixth most risky pair. Thus making the Orca robot even more reliable.

How it works

You need to register or use an existing account at Roboforex.com. Create a trading account in accordance with some requirements. Start a virtual server (VPS), install and configure MetaTrade4 trading terminal there, add our robot as an Expert Advisor.

The whole process doesn't take long and comes with full instructions from our team.

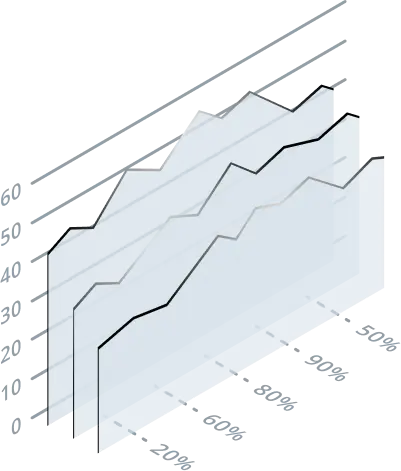

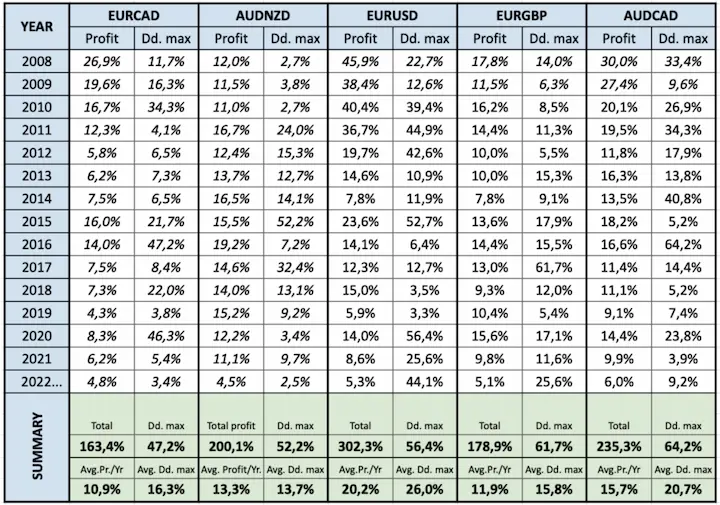

Profit & Risks

Results of the tests performed on the history of quotes from 01.01.2008 till 01.06.2022

The average annual profitability of a robot Orca operating on 5 pairs is 72%. It can be either higher or lower depending on the behavior of the market. The working drawdown of the robot is up to 5%. But it can be more. According to tests, it did not exceed 65% in 15 years. The robot is usually in a drawdown for no more than a week, although according to the tests there was a moment of a monthly drawdown.

The Robot automatically starts dry mode (stops opening new orders, only averages the existing grid of orders to close positions with a profit) when various conditions occur. By reaching the maximum number of orders in the grid (each pair has its own value), by 5% drawdown and by schedule - every Friday at 12:00 (Broker time). At the same time, it automatically exits the dehumidification mode when a good situation is detected. In addition, in dry mode, the robot will close the order grid before the price reaches basic take profit. It will close on a virtual take profit (when the drawdown for the pair becomes positive). Yes, this does not give a big profit value, but it significantly reduces the distance required for a rollback to close the entire grid.

If there has been a drawdown greater than 65%, then you can switch the timeframe to D1, which is quite logical, but at the discretion of the user - this will allow you to withstand a greater distance of the ongoing trend, but will also require a larger rollback, or rather even a reversal. If you do not switch, the robot will continue averaging and will wait for a small pullback, but it will withstand a trend continuation that is not as large as in the case of a timeframe switch. Topping up the Balance is not recommended, due to the fact that the lot will be large and topping up even 2x will be a drop in the ocean, and if the account merges, then along with topping up.

Despite the high reliability and very small chances to lose the deposit, there is still a risk. Two things are dangerous:

- No retracement trend of 7,000 - 10,000 pips in one direction. There were no such trends for 15 years for any pair, this certainly increases the chances that such a trend will not happen tomorrow, but does not make these chances equal to zero.

- Large total drawdown for several pairs. Mechanisms are provided that allow avoiding this option in 95% of cases. But 5% still remains.

To reduce risks, it is most reliable to withdraw part of the profit. Thus, over time, reducing the risks and bringing them to zero.